heloc draw period vs repayment period

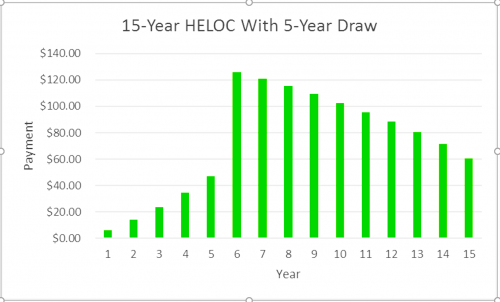

15-year draw period 15-year repayment period. HELOCs typically have a draw period of up to 10.

How A Heloc Works Tap Your Home Equity For Cash

Refinance Before Rates Go Up Again.

. The Repayment Period. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. The third column can be thought of as the draw period on a HELOC where the homeowner is making the minimum monthly payment.

First is the draw period during which you borrow money and make payments against the interest. Not specified for HELOCs. Some lenders offer fixed-rate HELOCs and HELOC.

Payoff Your Debt in 24-48 Months. With a HELOC you can make interest-only payments significantly reducing the amount you have to pay back each month. Home equity loans are typically fixed-rate loans that provide cash in a lump sum and have a set repayment period that ranges between five and 15.

Simply access cash as you need it using. The lender will charge fees if you roll the loan into another repayment. HELOC amounts range from 25000 to 500000.

Compare Top Home Equity Loans and Save. During the draw period you can borrow from the credit line by check transfer or a credit card linked to. This can be helpful if you will only be able to make.

Fill out application for personalized rates. You can even make interest-only payments during the draw period. Convert your HELOC balance into a fixed rate during your draw period or look for a fixed-rate home equity loan.

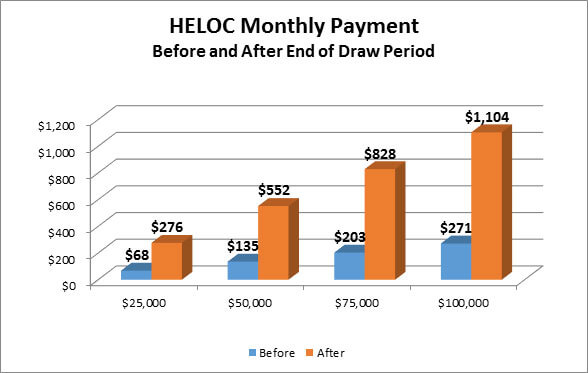

Keep in mind that unlike a credit card a HELOCs term is split into a draw and repayment period. HELOCs involve minimum monthly payments to cover interest during the draw period and significantly increased monthly payments during the repayment period based on. Ad 349 intro APR for the first 12 months.

A HELOC has two phases. Unlock your low rate on a HELOC 1 and have the funds you need to re-invent your kitchen pay for a wedding cover the cost of tuition or more. As low as 550 variable APR after 12 months.

Ad Compare the Lowest HELOC Rates. Home equity loans typically have fixed interest rates and a fixed repayment term of anywhere from five to 30 years. HELOC Payment Calculator For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments.

Best for Low Fees. Car title loans have a shorter repayment period usually 30 days making it more challenging to repay. Ad Call to find out more.

Ad Consolidate Debt And Fund Major Expenses By Unlocking Your Home Equity the Better Way. You can only borrow the money during this time. The repayment period typically lasts 20 years.

Special Offers Just a Click Away. Best Debt Consolidation of 2022. Ad Our Reviews Trusted by 45000000.

2 Personal Line of Credit is an unsecured consumer loan that consists of a two-year interest-only revolving draw period followed by a fully amortizing repayment period of the remainder. Dont Sit On Piles of Cash. During the repayment period your minimum monthly payment will be an amount necessary to repay the outstanding.

Home Equity Line Of Credit - HELOC. Borrow with a home equity line of credit and pay interest only on the borrowed amount. Ad Put Your Home Equity To Work Pay For Big Expenses.

The lengths of your draw period and repayment period will be specified in the HELOC loan agreement. The typical home equity line of credit meanwhile has. Ad Call to find out more.

Use Your Homes Equity To Finance Your Life Goals. Check Out Our Competitive Rates and Easy Online Application for 680 Credit. Apply Now Payoff Your Debt.

HELOCs usually have a draw period such as 10 years. Use Our Comparison Site Find Out Which Lender Suits You The Best. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral.

Ad Find The Best Home Equity Line of Credit Rates. Ad Find Best Debt Consolidation. Find the One for You.

Generally HELOCs come with a repayment period between 10 20 years. However at the end of the draw period the interest and principal will be rolled into one amortized monthly payment. HELOCs have two parts.

Top Lenders Reviewed By Industry Experts. The interest-only repayment option is an attractive feature of a HELOC. Age of the loan.

Skip The Bank Save. Pay the balance to zero. The draw period and the repayment period.

Then comes the repayment period when. A HELOC has two phases. Following the draw periods expiration the repayment period begins.

A draw period during which you can borrow against the line of credit as you wish and a repayment period during which you must repay the money youve. The repayment period is up to 20 years following a 10-year draw period. During the draw period which typically ranges from five to 15 years you.

Choose Wisely Apply Easily. Then theres a repayment period often as long as 20 years when.

Heloc Draw Period A Simple Guide For Borrowers

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Heloc Rates In Canada Homeequity Bank

Equity Repayment Home Equity Lending Third Federal

What Is A Heloc And How Does It Work

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Heloc Draw Period A Simple Guide For Borrowers

What Is A Heloc And How Does It Work Rodgers Associates

Heloc Payment Calculator With Interest Only And Pi Calculations

Heloc Rates And Loans In Washington Wafd Bank

What Is A Home Equity Line Of Credit Heloc And How Does It Work

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Heloc Rates And Loans In Washington Wafd Bank

Home Equity Loans How They Work And How To Use Them

/shutterstock_188743595.home.equity.loan.cropped-5bfc30d246e0fb00265ce4b2.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)